Order Report - Income & Net Worth: Ideas to Drive Consumer-centric Innovation by Helping with Personal Headwinds – a Quantitative Report

Report Overview

Get the complete picture of U.S. household finance with insights to understand the major struggles of certain consumer groups and how advice can address their personal adversities. This report covers employment, saving and investing accounts, and housing (as an expense and an asset, broken down by region). Also covered are second-earner income, credit card debt, student loans, and many other income and expense categories by lifestage and asset level.

Select Key Findings

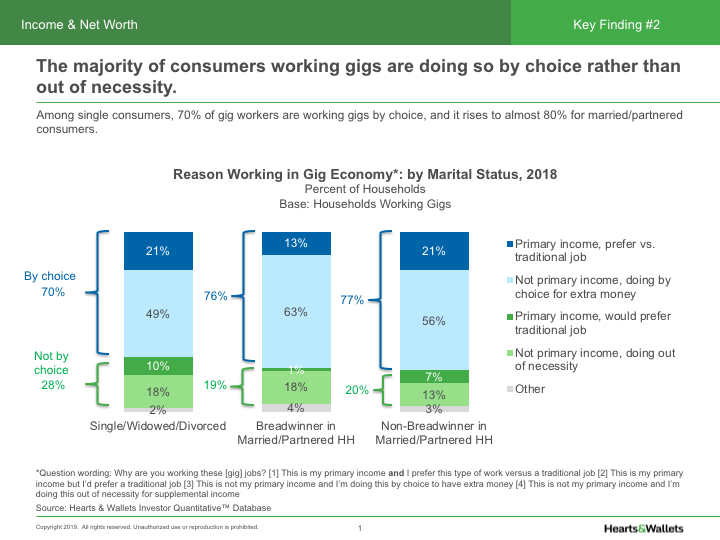

- Gig workers represent nearly a third of U.S. households, and they are receptive to advice and need more help than non-giggers.

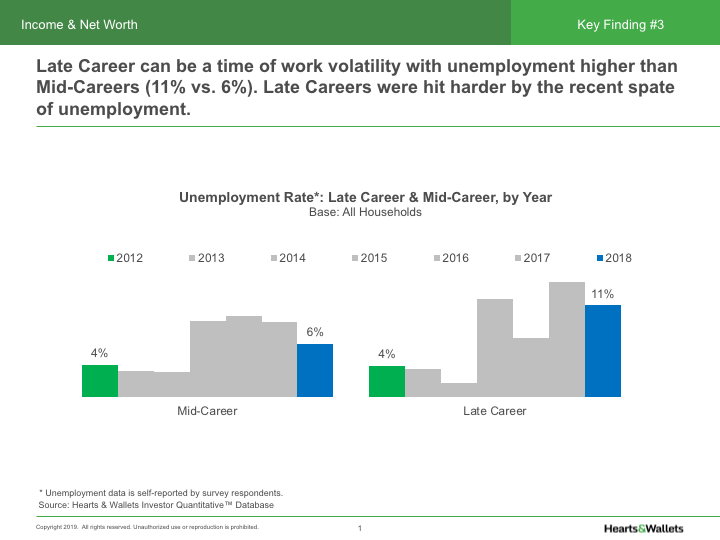

- Older workers ages 53 to 64 struggle with work volatility which affects their ability to earn and save.

- Housing takes the biggest bite from the household budget, consuming over half the monthly spend for consumers in metro areas like Philadelphia and Phoenix.

How This Report Helps

- Develop programs that address the specific needs of diverse groups from second-income earners to gig workers to older workers who grapple with career volatility.

- Reinvigorate marketing of taxable brokerage accounts as viable saving vehicles.

- Improve advice capabilities on debt.

- Incorporate real estate into financial planning advice and reflect regional differences.

About the Hearts & Wallets Investor Quantitative™ Database

The Hearts & Wallets Investor Quantitative™ Database (IQDB) is the comprehensive resource for understanding and analyzing behaviors and attitudes of retail savers and investors. With over 1,600 fields and derived variables, the breadth and depth of topics covered is designed with decades of hands-on experience in the marketing, product, service and research functions it serves. The database covers consumers of all age and wealth segments, with over 5,000 annual responses to an online survey fielded mid-year since 2010. The large sample size of over 45,000 U.S. households permits sizing and profiling of virtually any demographic, behavioral or attitudinal definition for consumer groups. Its national weighting methodology allows for comparisons across years and customer/shareholder bases of leading firms.

This new 62-page report features 47 data-intensive exhibits.

Executive Summary

Key Findings and Implications, Favorite Statistics, Related Research

Employment up for breadwinners and second income-earners

Work Status of Household Breadwinner: by Age

Breadwinning Responsibility in Married/Partnered Households: by Year, by Age

Breadwinner Gender: by Marital Status

Work Status of Non-Breadwinner Spouse/Partner: by Breadwinner Age

Average Annual Household Income: by Marital Status

Consumers in gig economy receptive to advice and need more help

Earning Any Income from Gigs: by Household Marital Status, by Age

Reason Working in Gig Economy: by Marital Status, by Annual Income

Profiling Gig Workers by Demographics, Difficulties, Sources of Advice and Wants From Firm

Saving and income up, but Late Careers struggle

Savings and Annual Income: National, by Lifestage

Monthly Spending Level: Post-Retirees by Investable Assets

Late Career Analysis: Annual Income, Unemployment, Age Discrimination

Taxable brokerage rising, good for emergency funds

Account Type Incidence Rates: National

Months of Emergency Fund: National, by Lifestage, Feelings About Financial Security

Selected Account Type Incidence Rates, by Lifestage and Investable Assets

Taxable Brokerage Account Type Incidence Rates, by Investable Assets, by Year

Consumers trying to get out from under credit card debt and student loans

Non-Mortgage Debt: Total Debt Outstanding, by Lifestage

Student Loans: Incidence Rates, Total Debt Outstanding, Feelings About Financial Security

Spending by Category, Paying Down Credit Card Debt by Lifestage, Investable Assets, Parent Groups

Real estate, both an asset and expense, highly variable by region

Primary Home and Investment/Vacation Property: Ownership, Net Equity and Mortgage Statistics

Analysis of Net Equity in Real Estate vs. Investable Assets: by Lifestage and Investable Assets52-53

Spending on Housing, Utilities & Real Estate: by Lifestage, by Major Metro Area

Metro Area Real Estate Statistics

Appendix

Terminology & Definitions, Sample Sizes

Get the Income & Net Worth Report! Contact us for pricing options to order.

Select the desired report(s) and send a signed copy of this form to info@heartsandwallets.com or fax to 800-930-0966. We will prepare a separate invoice for payment.

By signing this form, I certify that I am authorized to make this purchase on behalf of my company (“Customer”) and that Customer agrees to the following terms. Hearts & Wallets grants Customer a limited, non-exclusive, non-assignable license to use the Hearts & Wallets’ report for Customer’s private, internal use only. Customer shall not use any portion of the report for external use. Customer shall not share the report with any third-party, shall not permit other persons to use the report, shall not create derivative works based upon the report, and shall not sell, lease, or otherwise transfer rights to the report. Any such forbidden use shall immediately terminate Customer’s license to the report. All title, ownership, rights, and intellectual property rights in the report shall at all times remain vested in Hearts & Wallets. Customer does not receive any ownership rights or intellectual property rights in the report. Upon receipt of this report, Customer accepts the report and agrees to pay the amount specified.

Select the desired report(s) and send a signed copy of this form to info@heartsandwallets.com. We will prepare a separate invoice for payment.

By signing this form, I certify that I am authorized to make this purchase on behalf of my company (“Customer”) and that Customer agrees to the following terms. Hearts & Wallets grants Customer a limited, non-exclusive, non-assignable license to use the Hearts & Wallets’ report for Customer’s private, internal use only. Customer shall not use any portion of the report for external use. Customer shall not share the report with any third-party, shall not permit other persons to use the report, shall not create derivative works based upon the report, and shall not sell, lease, or otherwise transfer rights to the report. Any such forbidden use shall immediately terminate Customer’s license to the report. All title, ownership, rights, and intellectual property rights in the report shall at all times remain vested in Hearts & Wallets. Customer does not receive any ownership rights or intellectual property rights in the report. Upon receipt of this report, Customer accepts the report and agrees to pay the amount specified.